DocPharma Update

I spoke to Shashank Rai of DocPharma as part of a meeting with a member of our syndicate. I have narrated the conversation and the salient points that he pitched.

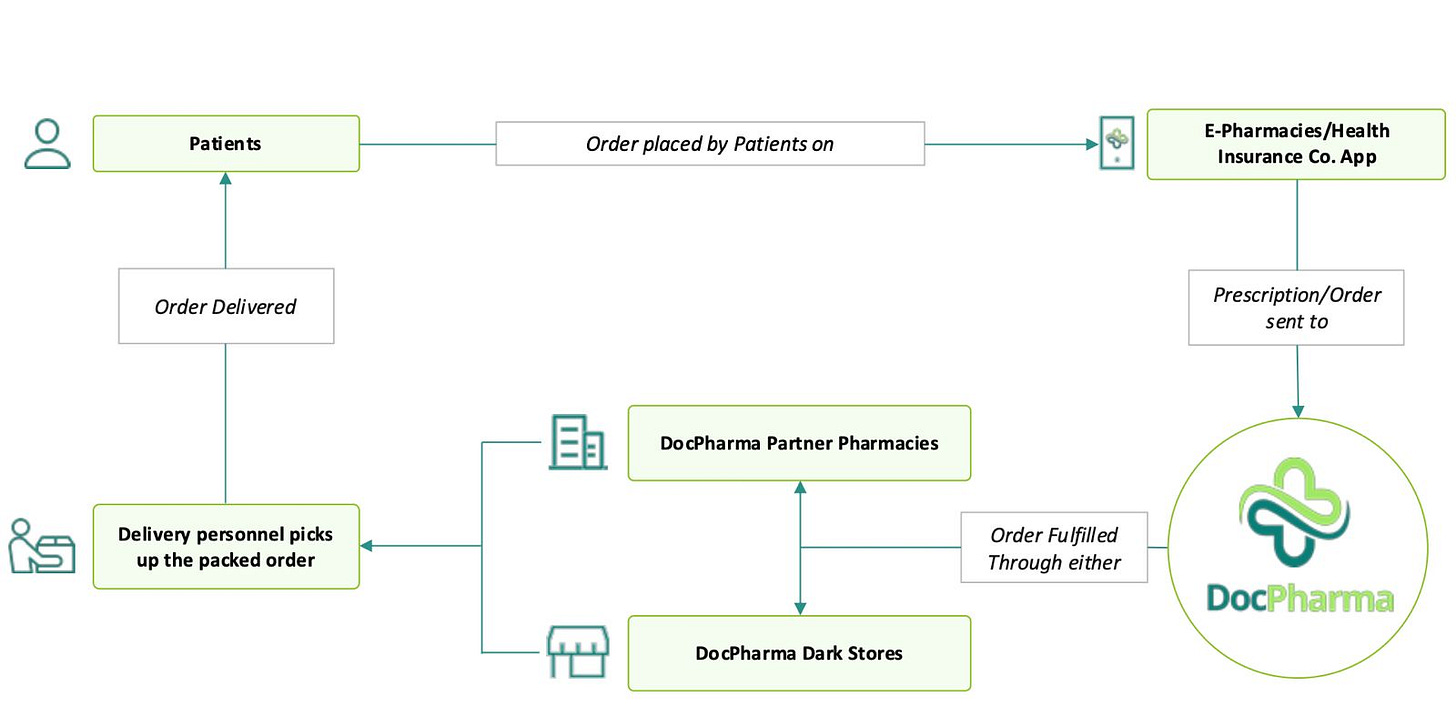

A few weeks ago I did a story on DocPharma which you can read here.

I got an opportunity to visit a few of their dark stores (in Mumbai) and pharmacies last few weeks to see the story in action.

And it is quite action-packed, to be honest. Shashank says:

“Amazon did it, Zerodha did it, Rapido did it. They all entered crowded markets and changed the game not by competing on features, but by completely reimagining the cost structure.”

The comparison to Rapido isn't accidental. While Ola and Uber were taking 20-30% commissions from both riders and passengers, Rapido flipped the script with a simple proposition: Pay Rs. 10 per ride, period. No percentage cuts, no surge pricing drama—just a flat fee that turned the ride-sharing business into a true marketplace where market forces, not platform algorithms, determined prices.

“That's exactly what we're doing with pharmacies,” Shashank explains.

The Data Goldmine

But the real story isn't in the deliveries—it's in the data.

In just over a year, they've processed 320,000+ orders across a network of 1.5 lakh unique customers approximately.

Shashank says, “We will have live inventory data from 1.5 lakh pharmacies now after our recent partnership with the dominant pharmacy ERP providers which on aggregate level have a presence of 85% of retail pharmacy space. We know which doctor is prescribing what medicine, which pharmacy stocks which brands, what combinations work, etc.”

This isn't just operational data; it's healthcare intelligence that pharmaceutical giants and insurance players are eager to access. The company's pitch to investors isn't just about logistics efficiency—it's about becoming the nervous system of India's pharmaceutical industry.

Here is a clip with the views of a pharmacist who is part of the DocPharma network:

The Amazon Playbook

Perhaps the most intriguing aspect of DocPharma's strategy is its long-term vision. Shashank frequently references Amazon's journey—a company that ran its core e-commerce business at a loss for decades while building AWS into a profit juggernaut.

“Amazon's e-commerce platform generated the volume that made AWS possible,” he explains.

“We're building the infrastructure today that will support multiple revenue streams tomorrow. Brand partnerships, data insights, insurance partnerships—all built on this foundation.”

How could it go wrong?

I asked Shashank how could it all collapse. What is the worst-case scenario?

Shashank thought for a while and said there are only three ways a platform like theirs go bust — either demand gets disrupted or supply gest disrupted. Or regulations kick in and they turn out to be unfavorable for the platform.

The pharmaceutical industry is governed by a 1947 act that was never designed for digital platforms.

“Companies with more than 49% FDI can't get drug licenses,” Shashank acknowledges. “We're an aggregator, so we don't need one. But regulations could change.”

The comparison to Paytm's regulatory troubles hangs unspoken in the air.

“Regulations can kill a company or crown it the industry leader,” he admits. “You have to be prepared for both scenarios.”

The irony isn't lost on anyone: DocPharma is enabling the very platforms that could eventually acquire or compete with them. But Shashank sees this as inevitable.

“When the market consolidates—and it will—these players will need our infrastructure. Building their own supply chain will cost more than acquiring us.”

“There are 1.5 lakh pharmacies,” he points out.

“They can't all suddenly decide to work exclusively with one platform. But online pharmacy companies? They could consolidate tomorrow.”

It's a calculated gamble, but one backed by the reality of Indian market dynamics.

The Hedge Bet

Recognizing these risks, DocPharma isn't putting all its eggs in one basket. They're expanding into lab services, building D2C brand partnerships, and developing data analytics capabilities. The goal isn't just to survive market consolidation but to emerge as an essential piece of India's healthcare infrastructure.

As the conversation winds down, Shashank shares one final insight:

“We're not building a delivery-aggregator company. We will make money there too, but that is not where the real value lies. We're building the invisible backbone that makes healthcare more accessible. And the data and processes we run will be valuable for multiple players in the industry.”

In an industry often obsessed with flashy consumer apps and billion-dollar valuations, DocPharma is betting that sometimes the most valuable platforms can be the ones you never think about.

DocPharma is raising $5 million in a pre-series A capital raise. They ended Q4 FY25 at Rs 8.5 cr platform sales.