From 7-Day Waits to 60-Minute Delivery: The DocPharma Interview

While media writes epitaphs for kirana stores, DocPharma is empowering local pharmacies by enabling them to deliver medicines within 60 minutes. They do this as a B2B2C using insurance as their wedge.

"We are not eating your business. These are not your customers originally. We are giving you an additional line of revenue, which is coming specifically via corporates and insurers.”

This is what Shashank Rai and Saquib Ali have been explaining to pharmacies as they add them into their delivery network.

It's a typical busy morning at Ramdev Medical, a spacious 2,500-square-foot pharmacy in Bangalore's Whitefield area. The owner watches as his staff attends to the steady stream of walk-in customers—roughly 350 people in a day who collectively spend about Rs 90,000 daily at his counter.

But in the back of the store, something unusual is happening:

This scene plays out nearly 100 times a day at Ramdev Medicals Whitefield, generating an additional Rs 100,000+ in daily revenue—more than doubling the pharmacy's business without cannibalizing its existing customer base.

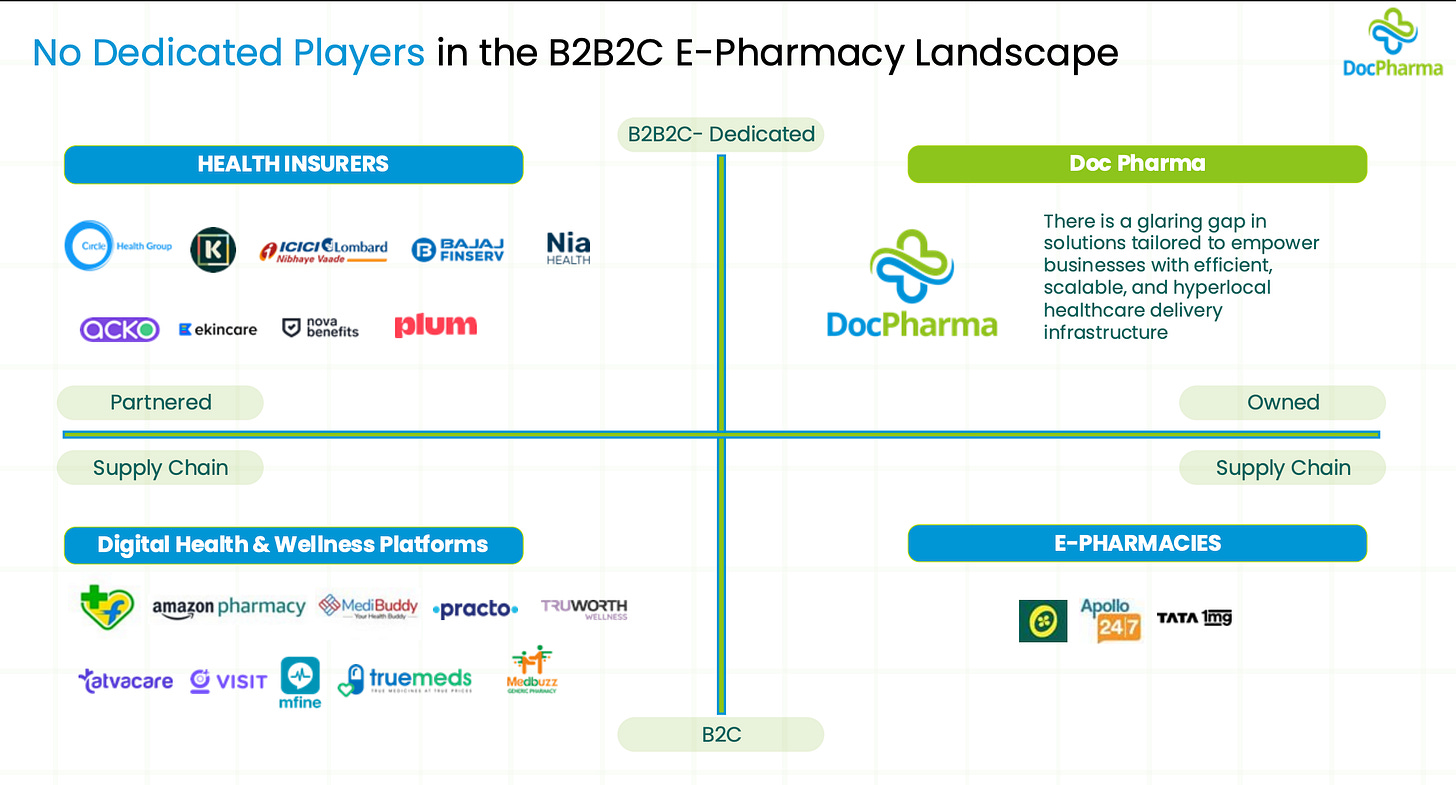

In a market dominated by well-funded giants like Tata 1MG, Apollo, and PharmEasy, two entrepreneurs have discovered an untapped opportunity in India's pharmaceutical delivery space.

Their company, DocPharma, isn't competing for customers in the traditional sense—they're building the backend infrastructure that enables e-pharmacies, doctors, hospitals, healthcare platforms, and insurance providers to deliver medicines within 60 minutes.

“Previously, players tried doing it. The only problem was they were dependent on the B2C part of it," Shashank explains.

"So at the end of the day, they were actually eating the pharmacy's business providing discounts and then stealing the same customers that would have otherwise used the pharmacy,” Saquib adds.

Approximately 30 Ramdev Medicals in Bangalore are a part of the DocPharma network.

In the above video, you can see the owner of Ramdev Medical in HSR Layout, Bangalore, talk about his experience of working with DocPharma.

He reports that his pharmacy sales have grown by 30-40% directly because of DocPharma because his customers are not being cannibalized.

This creates compelling economics for pharmacies.

The story of Ramdev Medicals represents a breakthrough solution to one of healthcare's most persistent problems: timely last-mile delivery of medicines.

Before DocPharma, patients covered by insurance would wait up to a week for their prescriptions.

“We were looking at a problem where it was taking around 4 to 7 days for medicines to reach the end consumer, especially people who are buying through insurance,” the founders note.

The consequences of this delay extended far beyond patient inconvenience. It fundamentally undermined the entire insurance system.

Saquib explains:

"If you see the utilization, out of 100 people who have insurance cover, only 4% opt for cashless in OPD (outpatient department). The remaining 96% would bypass their insurance benefits entirely, paying out-of-pocket and then enduring a lengthy reimbursement process.”

The founders realized that “if we do speedy deliveries, then we can take this utilization from 4% to 20-25% at least,” potentially transforming how insurance-covered prescriptions are fulfilled in India.

The timing couldn't be better. Shashank points out:

“In the last 5 years, pre-COVID vs post-COVID, OPD insurance has grown 4X!”

Shashank’s Supply Chain Expertise

Shashank Rai's journey begins in Varanasi, where he grew up in a family of doctors. "In my house, I am the only guy who is an engineer. Rest all are doctors," he reveals. This unique position gave him early exposure to healthcare systems—his family owns a 700-bed hospital in Varanasi, and his sister works with the Mayo Clinic in the US.

After completing his MBA, Shashank entered the e-commerce industry, joining Udaan in 2019 to head Operations for Uttar Pradesh.

Saquib’s Journey From Golfer to Entrepreneur

Saquib Ali's path to entrepreneurship was quite different. Unlike Shashank, he never envisioned himself as an engineer. “At that time, I either wanted to do some kind of business or law. But somehow I ended up doing engineering,” Saquib explains.

“I used to compete in Golf tournaments. I joined Amity University, and they also made me the sports manager, cultural head, etc. It was my responsibility to bring in sponsorship. My business journey started in the first year of my engineering,” he recalls.

He then moved to the EdTech space, launching his second startup, Tinkering Plus Technologies. This venture provided extracurricular activities and programs in schools.

"Within almost six months we generated around Rs 1.8 crores revenue. And margins were more than 50%. So we were profitable," Saquib notes. However, the COVID-19 pandemic forced schools to close, and with parents unwilling to spend on extracurricular activities, the business had to shut down.

That's when Saquib joined Udaan in March 2020, six months after Shashank had joined the company.

The Origin Story: From Udaan to DocPharma

Shashank and Saquib's paths crossed at Udaan, at the time India's largest B2B e-commerce platform, where they worked in complementary roles.

Shashank was heading Operations for Uttar Pradesh, while Saquib was heading Business for the state.

Their professional relationship was built on a strong operational foundation. Saquib recalls:

“Shashank and I were very much focused on running a profitable supply chain — all the cities we were running were profitable.”

After leaving Udaan, Shashank moved to Bangalore in December 2021 and joined Flipkart, while Saquib moved to Medibuddy as Head of P&L and relocated to Bangalore in 2022.

By early 2023, combining Saquib's healthcare industry knowledge and Shashank's supply chain expertise, they had identified a significant problem in the healthcare ecosystem—one that wasn't being addressed by the major players.

The Business Model: Filling the Supply Chain Gap

Their entrepreneurial journey began unexpectedly during the first COVID-19 lockdown in 2021. Living in an apartment complex with around 1,500 flats, they identified a critical problem: residents couldn't access groceries or medicines. While Udaan helped them solve the grocery challenge through B2B relationships, medicines remained a struggle.

"What we did was we tied up with a couple of pharmacy stores where we did a pro bono delivery of medicines," Shashank explains. "We used to take orders on WhatsApp and started delivering to the people in the apartment."

This improvised solution became their testing ground. From those 1,500 flats, they generated a business of around Rs 15 lakh monthly—all while investing their own money and helping people during a crisis. The lockdown experience gave them valuable insights into unit economics for medicine delivery.

DocPharma's innovation lies not in creating another consumer-facing app but in building the infrastructure that powers medicine delivery for platforms that already have these customers.

"Our entire supply chain is integrated. If you have customers, we provide the rest—kind of like an AWS of healthcare supply chain," Shashank explains.

This approach addresses a fundamental challenge in the industry.

Major platforms connect patients with healthcare services, but they don't have the supply chain to deliver medicines quickly.

Meanwhile, the e-pharmacy apps have their own interests at heart.

For example, healthcare platforms acquire customers for, let’s say, Rs 800 CAC, and they push the orders to one of the e-pharmacy service providers that provide the delivery service.

But e-pharmacy apps themselves are also in the same space. So there is a high risk that they can divert the leads and upsell and crosssell to them with offers.

This creates a lose-lose situation for healthcare and insurance providers.

DocPharma solves this by positioning itself as a neutral player—they don't have a B2C front that would compete with its partners.

“We don't generate demand. Hence, we spent zero on CAC in the last 1.5 years, and today we are doing a business of Rs 2.5+ crores a month without any CAC, absolutely zero marketing spend,” Shashank states.

The Supply Chain Revolution: Empowering Local Pharmacies

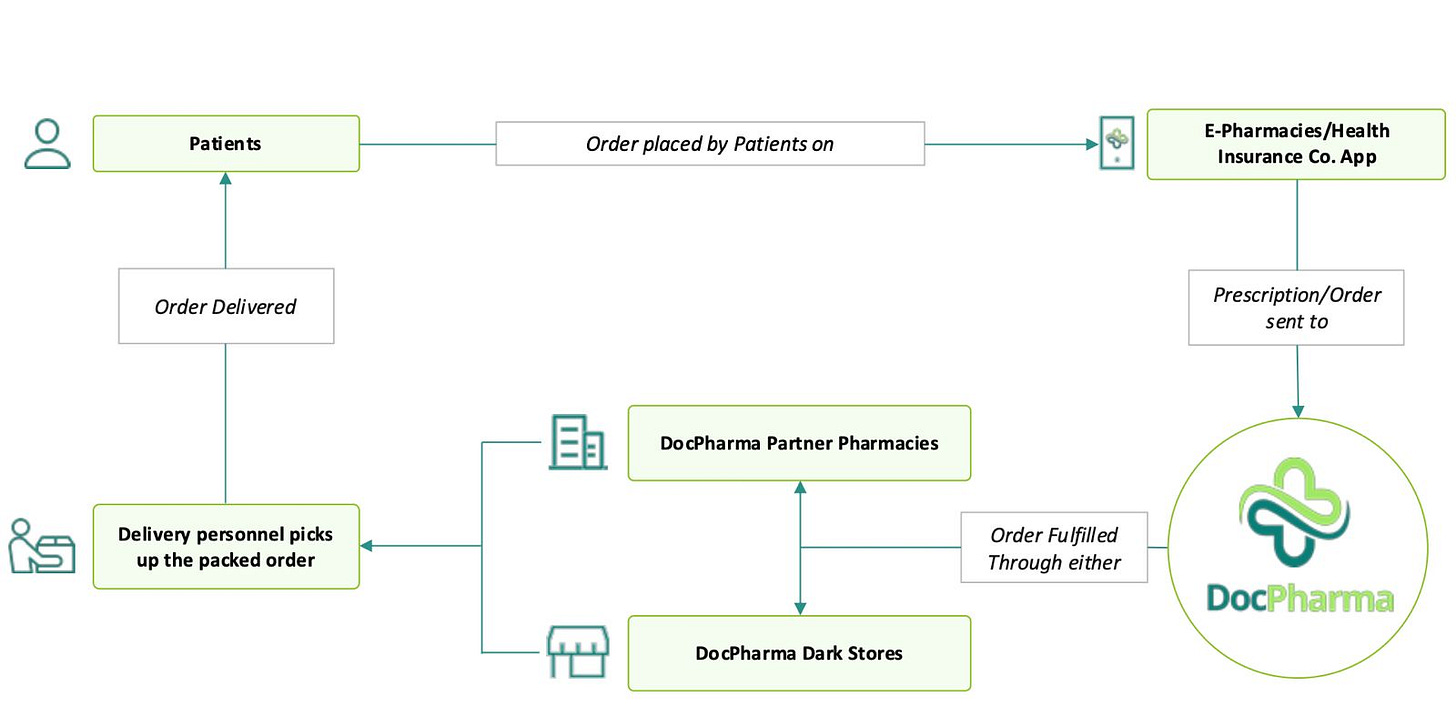

Unlike competitors who build expensive dark stores and warehouses, DocPharma takes a different approach. To fulfill orders, they've created a network of local pharmacies in addition to their own dark stores.

“Rather than spending on CAC, the margins which we are getting, we are spending on expanding the supply chain,” Shashank explains.

Their model works through two channels:

Partnered Pharmacies: DocPharma integrates with local pharmacies' inventory systems. When an order comes in, they identify which nearby pharmacy has the medication, and their delivery fleet picks it up.

Dark Stores: For areas without partnered pharmacies, they maintain dark stores for next-day or same-day delivery.

Currently, "60% of orders are getting delivered through our medical stores and 40% of orders are getting delivered through our dark stores," Shashank notes.

The pharmacies are happy to work with DocPharma:

“We are integrated with the ERP in these pharmacies,” Shashank explains.

This allows DocPharma to check inventory in real time and route orders to the pharmacy with the highest availability within a 3 km radius of the customer.

The Technology Backbone

When an order comes in, DocPharma system:

Identifies the customer's location

Finds pharmacies within a 3 km radius

Checks inventory across those pharmacies thanks to its integration with the pharmacy’s ERP

Routes the order to the pharmacy with the most complete inventory

Dispatches a delivery person once the order is invoiced

Ensures delivery within 60 minutes in metro areas.

Privacy is maintained throughout:

“We don't send any data to the pharmacy store—email ID, phone number, address,” Shashank explains.

“As soon as the pharmacy gets an order and generates the invoice, we get a trigger, and we assign a last mile partner to it.”

The Growth Journey

DocPharma's approach is yielding impressive results.

In March 2025 alone, they processed 40,000+ orders with an average order value of Rs 700+.

“We did a GMV of Rs 3.6 crores in FY24. Net revenue was Rs 2.6 crores. This year in FY25, net revenue is projected to hit Rs 14 crores. Next FY26, net revenue we are aiming for 3-4X,” Shashank projects.

"We are operational in 12 cities at the moment. And we are starting to increase the depth to tier 2, tier 3 cities as well," Saquib notes.

The Cofounders: Complementary Strengths

What makes DocPharma work is the complementary skillsets of its founders. Shashank brings operational excellence and supply chain expertise, while Saquib excels at business development.

Their divergent career paths before DocPharma prepared them perfectly for their current roles.

“I have a good network in this domain. We are a team of around 55 people; all of them were in my phonebook before I reached out to them to hire them,” Shashank shares, highlighting his operational strengths.

Meanwhile, Saquib's business acumen is unparalleled, according to his co-founder.

"Saquib is a great people’s person and can build a deep relationship with anyone. He is inimitable that way," Shashank states confidently.

The Market Opportunity: Building a Healthcare Infrastructure Layer

This approach positions DocPharma as the supply chain partner for anyone generating demand in health and wellness.

Their model addresses a pain point that pure B2C players cannot solve efficiently: the fragmentation of the healthcare supply chain.

“The healthcare market is so segmented. There are more than 1000 brands in the market. The largest player in the market is Sun Pharma, whose overall market share is only 7%,” Shashank explains.

This fragmentation makes it difficult for any single player to stock all 7.5 lakh SKUs in the market.

By leveraging local pharmacies, which have curated their inventories based on nearby doctors' prescribing patterns, DocPharma can fulfill a broader range of prescriptions than warehouse-based competitors.

The founders specifically see an enormous potential in India's evolving healthcare insurance market. "We expect that by 2030, probably every one out of five people have an OPD insurance," Saquib predicts.

This trend follows patterns seen in developed markets. As Shashank points out, "The developed countries—US, UK, China, Europe—everywhere 100% medicines are covered."

In an industry where customer acquisition costs can run into hundreds of rupees per user, DocPharma has found a different path. By focusing on the infrastructure layer rather than competing for end customers, they've created a model with positive unit economics from day one.

“We are doing two things for that,” Shashank summarizes their approach.

“First, our supply chain is our product. We are building the supply chain for these backend players. Second, we are empowering local pharmacies rather than replacing them.”

This strategy positions DocPharma not as another e-pharmacy but as the essential backbone of India's evolving healthcare delivery system—connecting insurance providers, healthcare platforms, and local pharmacies to deliver the right medicines to the right patients at the right time.

As healthcare in India becomes increasingly digitized and insurance coverage expands, DocPharma's infrastructure-first approach may well prove to be the missing piece that enables the entire ecosystem to function more efficiently.

Information has been sourced via several interviews with the founders, industry players and their pitch deck.

DocPharma is in the process of raising its Series A. The company is projected to have generated Rs 8+ crores in Q4 FY25.

The company is raising $5 million.

If you wish to participate in this round or want to inquire about relevant information regarding the company, write to us at banjan@tal64.com soon with your details!