The Fredun Story

Fredun Medhora has built a ₹500 crore revenue pharmaceuticals-to-consumer company, compounding at 30% CAGR over 17 years. He believes his company has finally arrived at its inflection point.

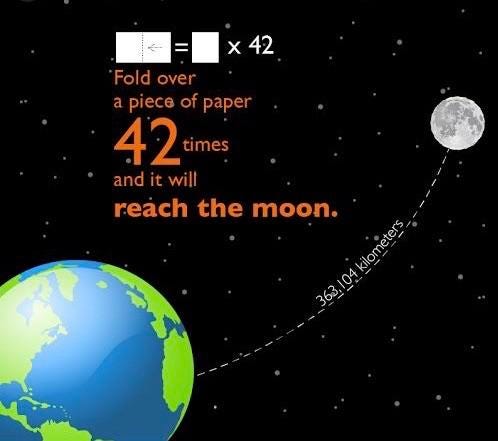

42 times.

How many times does one need to fold a piece of paper for its thickness to reach the moon? A standard sheet of paper is about 0.1 mm—so 42 folds would give us 0.1 * 242 = 439,80,46,51,110 mm.

Math, Fredun Medhora insists, is inevitable. He says:

"For the first 24 folds, you are still a few meters above the earth. And then you hit the inflection point. By the time you do the 42nd fold, you are going past the moon."

"In my view, today Fredun Pharmaceuticals Limited (FPL) is somewhere between its 23rd and 24th fold."

Scaling laws only permit any scale efficiencies to kick in after a period of flatlining. It is not possible any other way. Especially when you are building a manufacturing-first company like Fredun is building—one that his parents named after him, no less.

He joined the company that his research scientist parents had founded as a 20-year-old boy, barely out of college in 2007.

The revenue of the company that year was approximately ₹3 crores. Today, FPL is crossing a turnover of ₹500 crores.

"As you can imagine, I have been—quietly and diligently—folding my sheet of paper for a very long time."

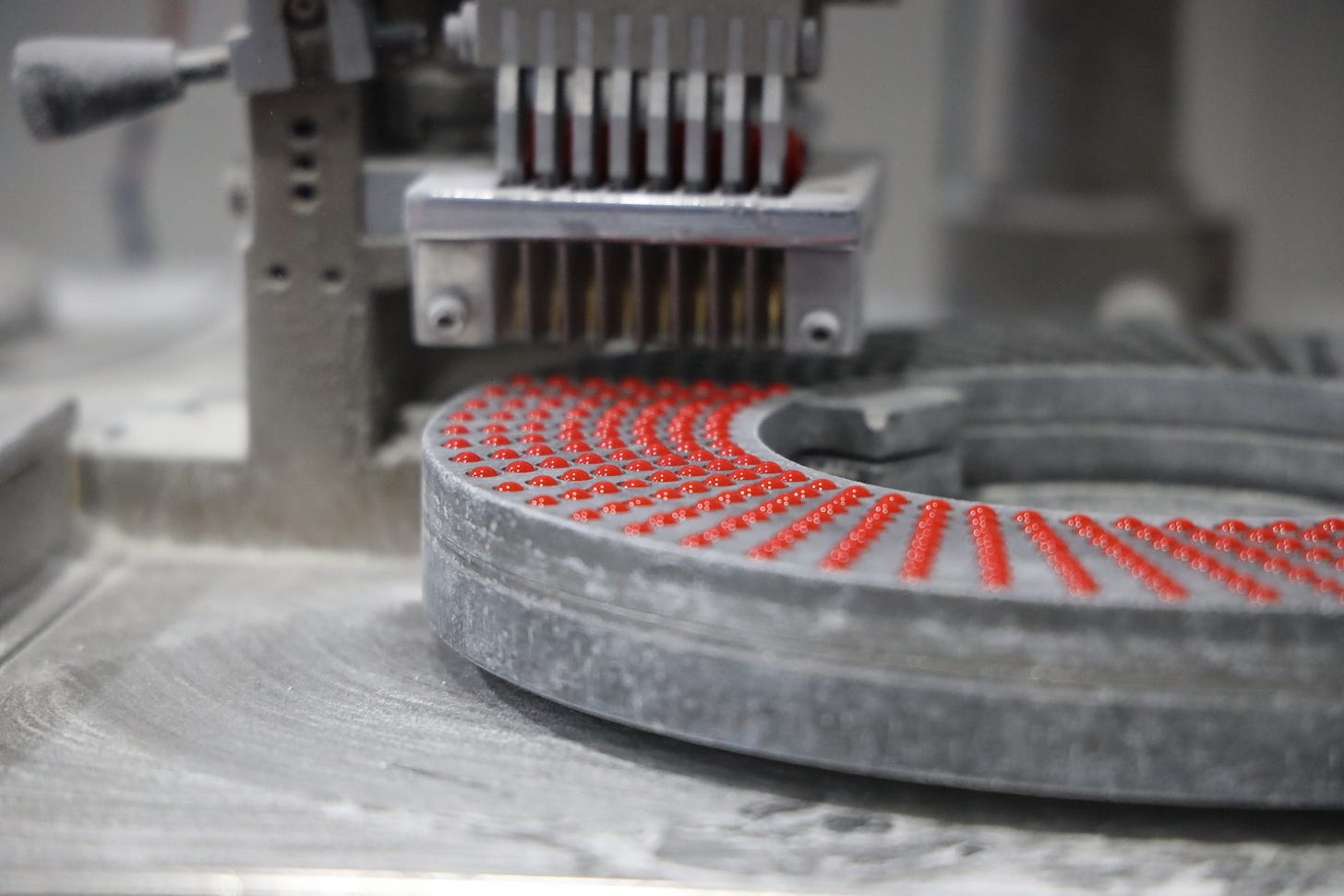

At 38 years old today, Fredun has built a plant with 163,000 square feet of manufacturing alone, with an additional 215,000 square feet of warehousing to go with it.

FPL has also commercialized a separate 18,000 square feet facility focused on manufacturing prescription pet food—India’s first pharma-grade functional pet food plant.

It has become a ₹500 crore revenue company spanning 52 countries, at the moment. And the forward investments made by FPL into its manufacturing infrastructure in the last five years are already good enough to double the revenue in the next five.

History

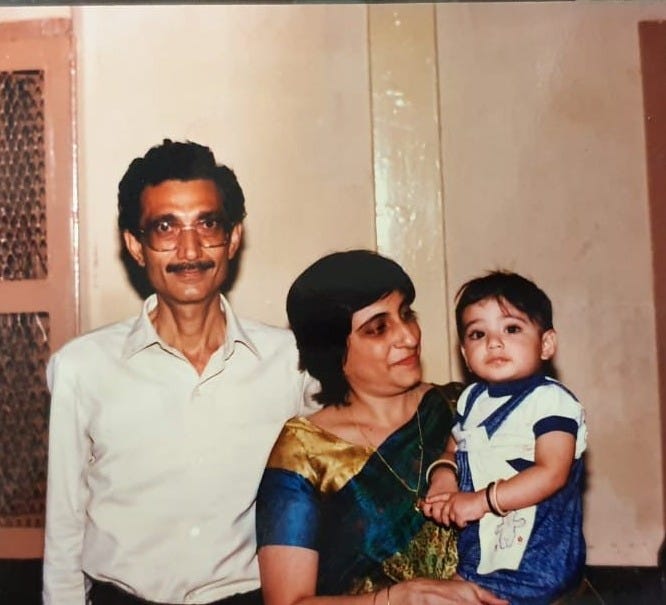

Nariman Medhora was 50 years old when he quit Sarabhai Chemicals to start a small pharmaceuticals trading firm.

By 1989, he had saved enough to buy a piece of land in Palghar to start constructing a pharmaceuticals plant there—what would become Fredun Pharmaceuticals Limited. The plant went live in 1994.

"He had balls of steel," Fredun Medhora tells me.

Fredun's father had worked at Sarabhai Chemicals for 27 years before taking this leap.

While he worked there, he'd eaten food only thrice a week, walked 10 kilometers daily to save money, and had a portion of his intestine removed due to malnutrition—all while supporting his separated parents' families.

At 46, he met Fredun's mother—Dr Daulat Medhora—a freelance research scientist who used to consult with brands such as Sanofi, etc. At 51, he became a father. At 54, they mortgaged everything to start a pharmaceutical company in Palghar, which was still just a village on the outskirts of Bombay.

"My childhood went by like a forest fire," Fredun recalls.

"In every business photo from that era, there's a small child in the corner—that is me. After school, I'd go straight to the office. I remember my parents calming down the creditors, nudging the debtors for money, and all of us running pillar to post."

This turned into an education of sorts for Fredun. While he ended up racking up a stellar academic record, through his bachelor’s in the US and master’s in the UK, nothing compares to the education the beatdown market can hammer one with.

It was those early experiences working for his parents in Bombay of the 1990s and 2000s that truly shaped him.

"I had no benchmark to compare my parents’ experiences and what I was experiencing while working for them. It was part of life. I felt that this is how it is in business and I thought all this is normal. For a long time, I had no idea about any other way."

When Fredun joined the company in 2007 at age 20, the "plant" was 22,000 square feet in size. FPL had two packing lines. The company could make 900 kg of granulation per day.

But even this modest operation was built on a foundation of thorns.

Within two years of starting production in 1994, their CA had attempted a hostile takeover. Then came Baddi—the North India excise-free zone.

"Suddenly, within a matter of a few months, we lost 90% of business because everyone shifted to the North," Fredun explains.

His parents couldn't afford to set up a new plant there. His father was already past 60.

In 2002-2003, new regulations prohibited beta-lactam and non-beta-lactam production in the same facility.

Ninety percent of FPL’s business was beta-lactam. His father chose to bet on the long term instead of taking a short-term win and decided to focus the manufacturing efforts on non-beta-lactam, losing almost everything again.

By 2007, they were essentially starting from zero for the third time.

"I used to do everything," Fredun remembers of his early days.

"I used to lift goods. I used to do the security job. I used to clean up after the housekeeping. I used to stand on the machines and run the machines myself. I think I must have walked at least 40 kilometers per day in just the factory."

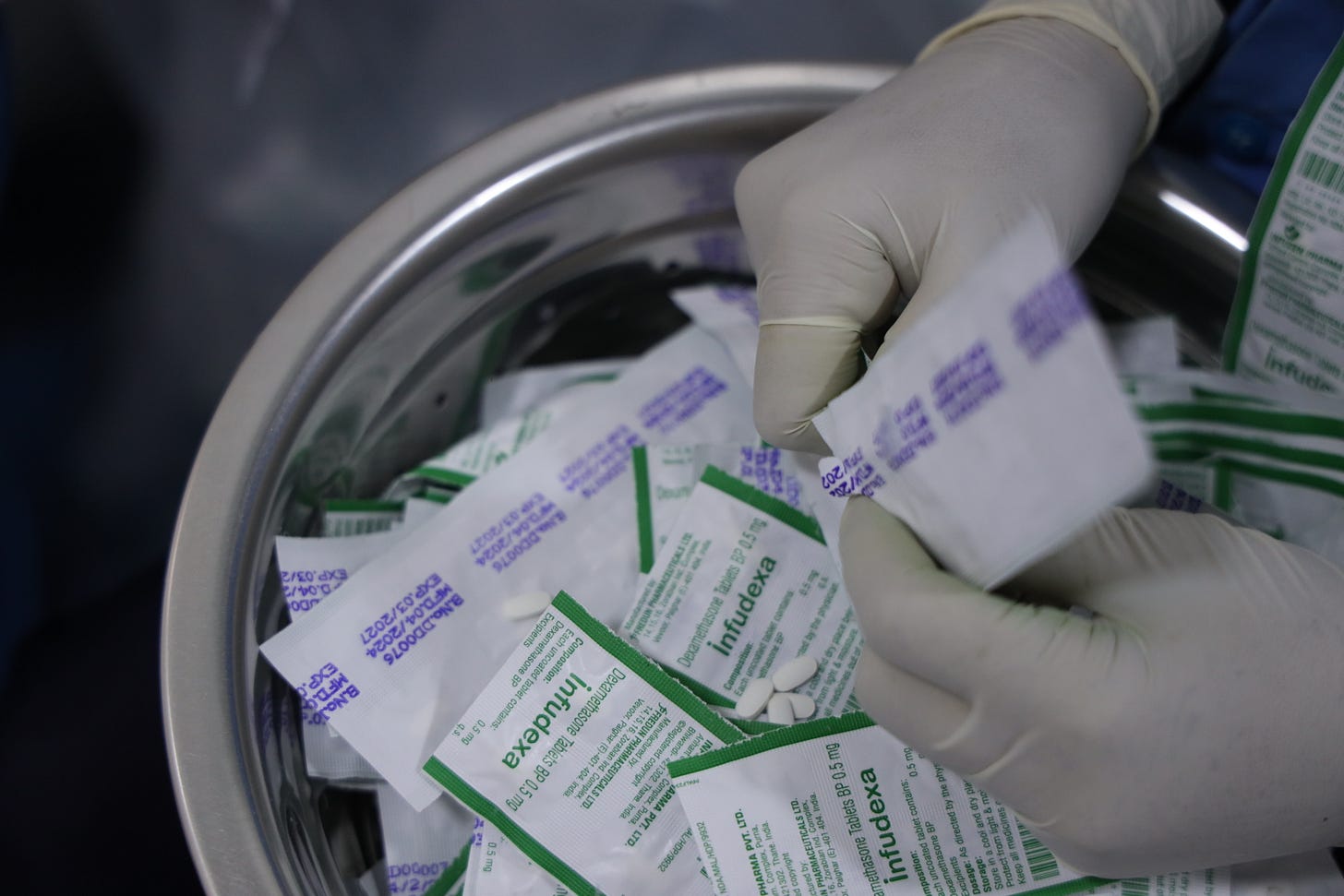

In 2007, someone in the plant sabotaged a production line—they had sabotaged the products and sent them over to the client. For six months after that, Fredun would himself pack every single pack that came out of the packing line.

While Fredun gained stellar business education, he started developing his vision of how the company could grow. But that came with its own set of challenges.

"Nobody would want to talk to a 20-year-old," he says.

"When they are dealing with someone in the business, they would want the decisions coming from someone else, someone older than me."

Building Dependencies on FPL

Fredun instinctively understood that his survival depended on making clients dependent on the company and its manufacturing capabilities.

"Back then, I would work for free also sometimes," Fredun admits.

"They started becoming dependent on me. I thought, let them exploit my offerings to the fullest now—allow them to in fact—and let me give such good quality products at such an unbeatable price that they have no other way out after they achieve scale themselves."

This wasn't about selling. This was about creating dependencies. For years, he executed this strategy instinctively.

He would tell clients he'd work at any cost, any price. He'd let creditors abuse him on calls and still demanded more supplies. Workers who were owed salaries would abuse him. The electricity guy would come to cut the wire.

"Many times that guy would turn up. I used to cajole and request him to give us two more days."

Meanwhile, he watched entrepreneurs—his peers across India—raise millions for half-baked products or no products at all.

"I felt like utter shit," he admits.

"The sad part is that all the investors I met—most of them cannot run a paan-tapri if their life depended on it. And I had to prove to them that I could build a company."

By 2011, things began to shift. The company that had been growing invisibly, painfully, suddenly started gaining momentum. Ten years later, cost efficiencies started hitting.

"I knew that once we crossed Rs 50 crores of quarterly revenue, cost efficiencies will start hitting."

"We eventually did that—in 2021—and our profitability started becoming visible."

The numbers tell the story: From 2 packing lines to 32. From 900 kg of daily granulation to 22 tons. Overall capacity increased by 1,600% between 2013 and 2021, then another 35% by 2025. The 22,000 square foot facility became 3,78,000 square feet of manufacturing+warehousing.

At 60% augmented capacity today, they can manufacture 4 crore tablets, 1 crore capsules, 250,000 tubes, 160,000 lotions, 22 tons of DC granules, and 1.5 tons of pellets—per day, simultaneously.

While the company started as a contract manufacturer for global brands, Fredun never intended to remain one.

Consumer Brands

Fredun reveals a strategic decision made years ago.

FPL’s Nutraceuticals—for humans as well as pets—weren't just developed—they were clinically validated with a unique distinction in the Indian market.

"We are the only company to have double-blinded nutraceutical studies in India. And we had them ready a decade ago," Fredun states.

"But again, we did not have the right bandwidth to launch the products back then."

"I did not supply them to other companies because I knew that these products are gold mines, they are kept within the company."

After spending more than a decade purely focused on building manufacturing capabilities and research, FPL finally decided to launch its own brands.

Building brands requires more than just manufacturing capabilities. It requires working capital to give credit terms to the market, infrastructure to handle returns, teams to manage distribution, and, most importantly, the ability to survive while customers take 90, 120, sometimes 180 days to pay.

"The plan was to launch FPL owned consumer brands throughout," he says.

"But I did not have the resources to start with. So I had no choice but wait until I had a strong enough infrastructure and balance sheet."

"Usually, in typical pharma companies in the West, the philosophy is to have a few star products around which the company gets built."

"In the beginning, I did not have enough capital to develop star products."

"So we took the opposite route. We have 1,700 products across 27 therapeutic ranges, and our products reach 52 countries."

Does it not make it difficult for management to focus?

"All this diversification is actually just line extension for us. We are already doing it for our existing clients as OEM. We took those products and launched them into the market."

"But when we launched a particular product, like in pet care, I cannot do with one product. Nobody will shelf my product only in the market. Nobody will shelf my distributors."

"So we have to have a product basket. We have to have multiple products, and we have to have a variety and inventory."

Fredun explained a few interesting examples that illuminate his and the company management’s thought process.

Example 1: Dermacosmectics

The dermacosmetics market in India is controlled by companies prescribing ₹4,000 shampoos and ₹2,800 serums—products with 90% gross margins sold directly to dermatologists. It's a closed circle, impossible to break into.

So FPL didn't try to break in.

The company went to these companies and offered to be their OEM manufacturer. They brought special licenses, manufacturing capabilities that no one else had in the country. For two and a half years, they quietly manufactured these premium products.

Then they launched their own line.

"When we first went to the doctors, my team used to turn the product around and say, 'Please check the manufacturing. You have been using my product only for the last 3 years.' The wall instantly shattered. Now they cannot say that it is of poor quality because it is my product. It has been there for the last 3 years."

FY25, they did ₹4 crores in dermacosmetics. With a team of just 4.5 people ("one person is working on two projects"), FPL is now targeting Rs 30-40 crores annually.

Example 2: Chuu Balm

Then there's the ₹5 pain relief balm called "Chuu"—40-50 times more powerful than other balms, targeting daily wage laborers who can't afford paracetamol.

Fredun explains, "The laborers who do manual work, carry loads, and earn daily wages must be experiencing shoulder, head, and overall body pain."

"We have a 5-rupee balm that lasts for two days."

In FY25 alone, Chuu Balm reported sales of Rs 3.5 crores. For FY26, the company is projecting sales of Rs 9 crores.

Editor’s note: If you are wondering why the word ‘Chuu’ sounds strangely familiar, let me clear all your doubts by showing the Vapourub product FPL is preparing to launch:

The Big Bet on Petcare

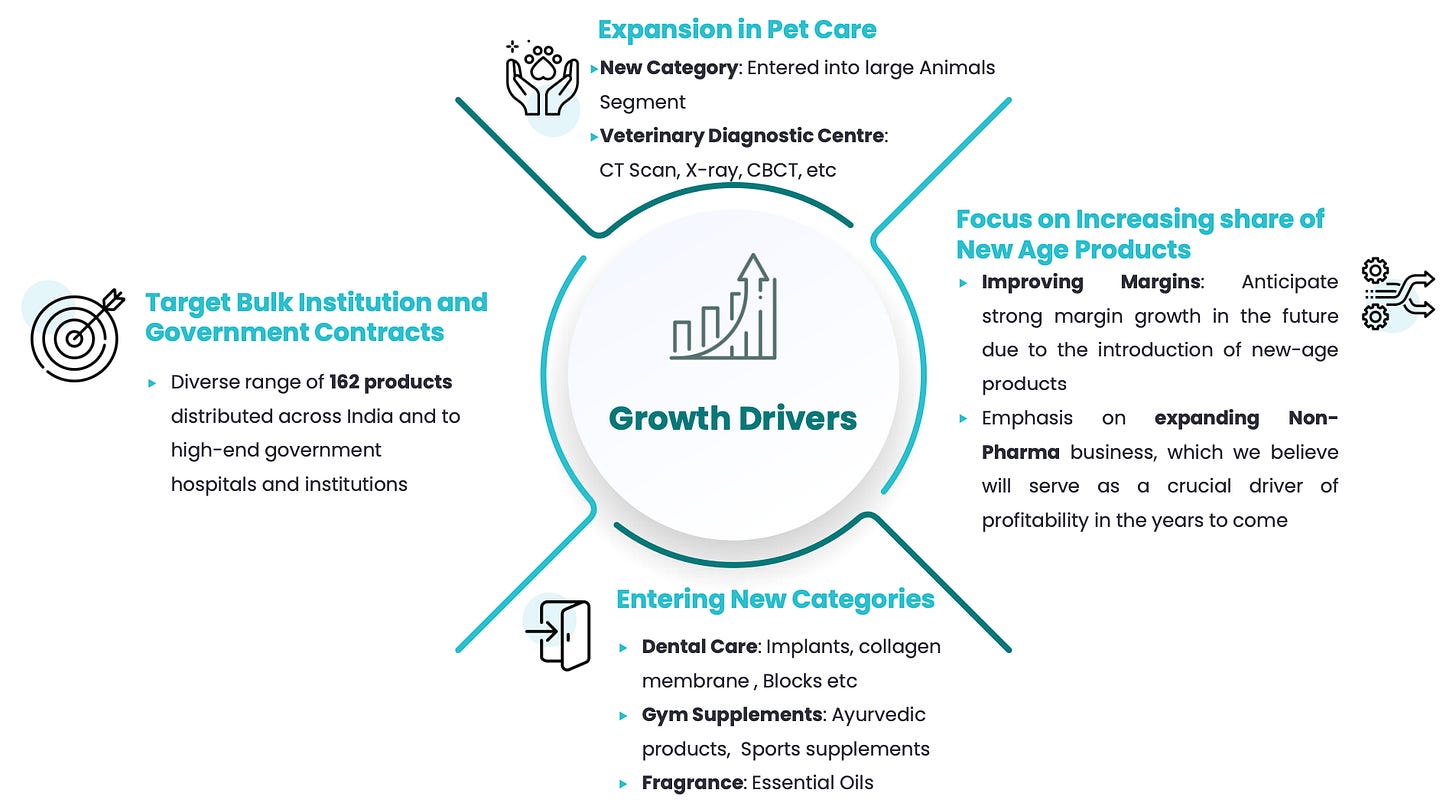

FPL’s pet care business—named Freossi—which did ₹30 crores in FY25, is built on a doctor-prescribed model that covers the full spectrum of animal health.

"We develop everything under the sun, including antibiotics, liver disease, chronic disease, everything," Fredun explains.

"For dogs and cats and other pets, but predominantly dogs and cats."

This therapeutic focus leverages Fredun's three decades of pharmaceutical expertise.

Even products that could be sold over-the-counter are positioned as doctor-prescribed, building credibility and ensuring proper usage. While competitors focus on kibble and treats, Fredun is building a pharmaceutical approach to pet health, leveraging FPL’s existing strengths in formulation and clinical validation.

"80-90% of the revenue of pet care currently is from allopathic formulations and nutraceuticals," Fredun says.

Fredun’s point of view with respect to pet food is also illuminating:

"How many of us eat 6-month-old roti?" Fredun asks.

"I don’t think we do. Then why are we giving 6-month-old food to our pets?"

"In many countries right now, especially nordic countries, they are banning kibbles. Kibble is 6-9 month-old food you are giving to your son or your daughter—because that's what you call your pet. A lot of the pet food available in the market is produced out of waste materials from poultry and meat industries."

This isn't just about biscuits or kibbles only. It's about a fundamental mismatch between what Indian pets need and what the market offers.

On one end, you have people feeding human food to pets out of necessity. On the other hand, you have premium brands selling what Fredun calls "dead food."

He advocates for home-cooked food for daily feeding but sees the opportunity in specialized diets:

"A home food can be given on a day-to-day basis that can substitute kibble and be good. But when the pet is sick, or the pet is not well, or the pet is growing and needs nutrition, or the pet is old when it needs support—that is the time you require a specific diet."

"I don't want Freossi to be a mass food player. I would rather have a prescription diet," he explains.

"Targeted therapeutic foods for eyes—for retina, for CKD, for liver function disease, for diabetics, for weight management, and so on. FPL wants to serve gaps like that."

"We have right now some products in <redacted>. We will be the first one in Asia to launch it for pets," Fredun reveals.

"These products are for anti-aging for dogs. Enhancing the geriatric dog's life. And improving the dog's life."

"If it enhances a pet's last few months, it is useful. Let's say the pet’s life is 12 years and 6 months—the last 6 months, if he/she is a little lively, then that will be so joyful."

Fredun has been quietly building FPL into the only petcare manufacturing facility in India that can manufacture nutraceuticals, herbals, ayurvedic supplements, allopathic formulations, diagnostics, and bone grafts under the same roof.

"This month (September 2025), FPL is commissioning what will be the first of its kind facility—18000 square feet of manufacturing—to have a pharma-grade facility for functional pet food in India."

This marks an important moment in FPL’s journey. It's the first of its kind facility to have a pharma-grade facility for pet food in India. The implications are significant

"That way we will be able to grow the OEM business also for other brands and also for our own products."

"Soft food, targeted therapeutic food, prescription diets." No "kibble or anything like Drools or Pedigree. That is not the kind of market that I want to enter into."

The new plant alone is projected to generate ₹150 crores in revenue over the next four years, with about half coming from their own brands and half from OEM manufacturing for others.

Insights on Petcare

Fredun’s central thesis is that the petcare market will mature and reach an inflection point, and when it does, FPL will be ready.

"Who are your first-line influencers? Not the doctors. It is the breeder you meet first. It is the dog trainer you meet twice a week. It is the dog walker you meet once a day. It is the dog groomer you meet twice a month. Those are your first line influencers. We are building relationships with them, making them dependent on FPL."

The psychology of pet food purchase by the pet parent is also crucial. He gives an example:

"I know so many people who give their dogs ghar-ka-khana (home food). Many times, because they have a vegetarian home, they don't want to give anything non-vegetarian to the animal."

"You have to realize that your pet does not go out and buy food. It is you who are going and buying for the pet. So the companies have to sell to you and not your pet. Your pet is just going to eat."

"You think your dog or cat wants to go and try a new treat every time? No. Because you are seeing a different packaging in the store, because you are seeing a different color. You think, 'Let me try this.' Your dog/cat is not asking for it. Maybe they hate it. Maybe they like the previous one much better. But it is you who has thought that we should buy this."

This understanding drives FPL’s approach: educate the human, not market to them.

The vision is clear: prescription diets for specific conditions, pharma-grade manufacturing standards, comprehensive diagnostic services, and products at every price point from ₹5 to ₹5,000.

"Eventually, you as a literate person will definitely know that this is not good, let's buy what is good quality food," he says about the evolution of Indian pet parents.

"Just like dalda—everyone used to eat dalda. Suddenly everyone realized that dalda is not good. That time will come. In 2-10 years everyone will realize that kibbles are not good."

When that realization hits, Fredun Pharmaceuticals plans to be there with an alternative for every need, at every price point, for every moment of a pet's life.

"Our goal for pet care is very simple," Fredun says.

"By 2032, no pet in India should be able to be born or die without using a Freossi product or service."

Given the infrastructure FPL is building, the dependencies the company is creating, and the fundamental shifts it is driving in the market, it might not be as audacious as it sounds.

Vet Diagnostics

FPL launched India’s first standalone Vet Diagnostics Center in Worli, Mumbai, at a price point of ₹16,000, with 24-hour report delivery. The response was immediate:

"The only other company which had a CT machine for pets was the Tata Hospital. They had to drop their prices from ₹56,000 to ₹22,000. But they still take a week to deliver the report. We deliver the report in 24 hours."

"We also have CT machine and India’s only Vet CBCT machine in the diasgnostic center."

The infrastructure FPL has built is comprehensive:

"We have 4 ambulances spaced across Mumbai. Someone from Vashi needs a CT scan—an animal needs a CT scan in Vashi, New Bombay. They can get a CT scan done within 38 minutes because we have a full-time 24/7 anaesthetist also at the centre."

The Human Architecture

What makes this growth sustainable isn't just strategy—it's the people.

"We have right now 127 employees who have been working with us since day one, even today, so 31 years. 215 people have been working with us for more than 15 years. We have 27 entire households where the mother, the father, the son, the daughter, the whole family comes to work at the plant."

This loyalty wasn't inherited—it was earned through crisis. The research team has grown from 2-3 people to 39. Each brand now operates like a separate company with its own CEO, operations team, supply chain, and R&D.

"We are overly organized for a company our size," Fredun admits.

His mother, the research scientist who developed MCHC (Microcrystalline Hydroxyapatite Compound) for Sanofi and TTK in India in 1987, still leads R&D at age 70-plus. It was her breakthrough that gave the company its first real product—a calcium supplement.

"It is the most bioavailable product in nature. Because it is made from bones. It has innate phosphorus in it. It has type 1 and type 2 collagen. It has glucosamine and glycogen. So it doesn't cause gastric discomfort."

"In India, nobody does R&D. Not even big companies. Everyone does F&D—Formulation Development. You develop something which already exists. R&D is when you invent something."

Financials

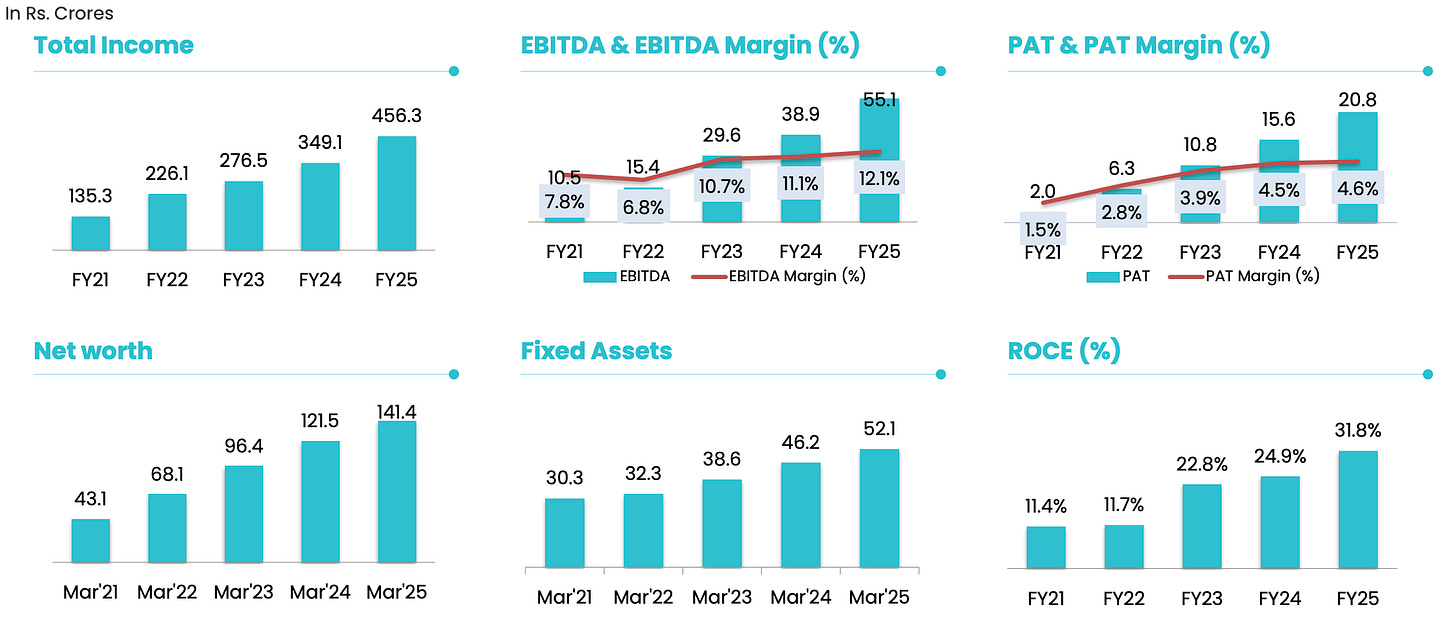

2007: ₹3 crores revenue

Today: On track to cross ₹500 crores

17-year CAGR: 30%

Products: 1,700 SKUs across 27 therapeutic ranges

Global reach: 52 countries, 692 registrations, 1,260 in pipeline

The diversification is deliberate:

"No country is more than 18% of my top line, no therapeutic class is more than 12-13%, and no product is more than 6-7%. We diversified so well that no demographic, geographical, or any other hindrance can cause any impedance to our growth."

An oft-repeated question that Fredun gets asked by his shareholders stems from FPL’s working capital debt, negative cash flows, its inventory days, and debtor days.

"Imagine you are starting ITC today and building your first hotel. Won’t you have to make 400 rooms first? Obviously, on the first day, you will have 400 times the inventory. Obvioulsy you will have negative cash flows in the beginning."

"We have 1,700 SKUs that we have. To make a product today, we need at least 30-40 ingredients. Because there are common ingredients, there are around 29,000 separate SKUs in the stock. Those inventories we have to build up because we have to hold a couple of months stock at the raw material level. We have to have at least a month, month and a half stock at the WIP level."

"The actual number of inventory might be higher later on but the ratios will improve in the next 7-8 quarters. You are seeing the trend from 320 days to now 210 days to 187 days, the trend is improving."

"Inventory is a belt you have to tie in your neck if you want to survive and grow."

What about FPL’s debtor days?

"Look at the growth trajectory - we went from ₹345 crores to ₹456 crores in revenue year-over-year. Yes, our debtors increased from ₹66 crores to ₹170 odd crores, but that's because we're growing so rapidly that each quarter's sales are massive compared to the previous one. In our last quarter of FY25 alone, we had ₹167 crores sales out of ₹177 crores debtors—that's essentially an entire quarter's sales still showing as receivables on the books."

"When you're building market distribution and creating dependencies with distributors, you have to offer competitive credit terms. That's how you establish yourself. In July we recovered ₹116 crores of debtors, but then in August we extended similar credit again because the business keeps growing. Someone looking at August in isolation might say we're back where we started, but they're missing the point—the absolute numbers keep growing because the business keeps growing."

On debt, Fredun clarified:

"Debt will temporarily increase maybe by 5-6%. We are already at peak level. It looks high optically but it is not because we have ₹230 crores of stock in hand. We have about ₹100 crores of debtors. And if you remove about ₹80-90 crores of creditors, we are almost net debt free."

And finally, Fredun comments on FPL’s cashflows:

"Cash flow will always be negative in this phase, right? I mean compare FPL to any venture funded startup, for example. If money goes into inventory, and if we have to give credit to debtors—does that mean that the business is not making money? How then is the check being cleared every day for 1.5 to 2 crores?"

"The cash flows are negative right now because there is working capital deployed in terms of stock and in debtors. Within 6 to 7 quarters, that numbers, that will change once the cost efficiencies start coming in to the new brands and the penetration phase begins to mature."

"You can't judge our working capital by absolute numbers when we're growing at this pace. We're essentially financing the market's adoption of our products, and once the penetration phase starts maturing, in 6-7 quarters, these metrics will normalize."

"We have happily sacrificed temporary profits by keeping the prices low for our customers because we want to build that dependency. That is our strategy."

Looking forward, Fredun projects:

Next 4 years: ₹900 crores revenue

Pet care alone: ₹250 crores (₹150 crores branded + ₹100 crores OEM)

By 2030-31: 51% revenue from new age brands

"In the next 10 years, we are aiming that we will have a few brands that are about ₹1000+ crores by revenue, each," he states.

"I think the market cap will take care of itself, eventually."

The ultimate vision is to split Fredun Pharmaceuticals into separate companies for each brand, with the parent as a holding company.

Each brand—Freossi, Fredun Nutrition, Fredun Mobility, Beauty Fred, etc.—already operates independently with its own CEO and complete team.

"The day they are able to stand on their own as a company and produce substantial revenue and profits, we will spin them out separately to unlock more value for our shareholders."

The Simple Secret

The company that started with 2 packing lines now runs 32, manufacturing 1,700 SKUs.

"We are cockroaches by definition," Fredun says.

"Pour cold water, pour hot water, we survive. We went through a lot of shit again and again, many times, we have seen the whole cycle."

"We are one of the largest plants in the country right now. Within the next 18 to 24 months, we should be in the top 2 or 3 pharmaceuticals plants for a single location in terms of size and output in the country. That will be my 24th fold."

"People can of course replicate everything we do but how will they replicate the time we have invested?"

After hours of conversation about strategy, dependencies, and market penetration, Fredun reveals what might be the simplest business insight I've heard:

"I think if you are an entrepreneur, you need to get mainly two things right. a) You need a good product, and b) you should not take money out of the system. That's it."

"If you are not removing money from the system and your product is good, there is absolutely nothing that can stop the company from growing eventually. In fact, in the beginning you may not even know where most of your future revenue/profits will come from. You just have to ensure the company doesn’t go out of business."

"Good things take time and time tells all tales."

For a company built on making people dependent on it rather than just selling to them, it might just be inevitable.

"All I have to do," Fredun says, "is stay alive."

If you want to discuss an opportunity with Fredun Pharmaceuticals Limited, please write to banjan@tal64.comSafe Harbor Statement: This story contains forward-looking statements that involve risks and uncertainties. Actual results may differ materially from those projected.