The Endurance Capital Interview

India is full of sound businesses around ₹10 cr revenue mark that struggle to scale as they are neither big enough to attract growth capital, nor going to scale to unicorn status. Enter Endurance VC.

The clock struck midnight as Archana Priyadarshini finally sat down after another 16-hour day.

Educated at IIT-Kanpur, she had worked in corporate America for a decade before returning to India to start Bootcamp Fitness—a chain of gyms for the growing cohort of aspirational fitness enthusiasts in Bengaluru.

As the sole founder running five Bootcamp Fitness gyms across Bangalore—HSR Layout, Sarjapur, BTM, Bellandur—she felt the weight of every decision on her shoulders.

“It was generating positive cash flow from the first month"—enabling organic growth from a single location to five. "I only invested in the first gym, and used the cash flow from that location to open additional gyms. I had scaled up to 5 gyms, all bootstrapped.”

Yet five years into the journey, exhaustion was setting in.

The gyms were generating cash, but scaling further seemed like a distant dream. With each new location, she faced the same challenges: raising capital, finding the right space, training staff, and managing operations—all while maintaining quality across existing locations.

Traditional banks weren't interested in funding her expansion without substantial collateral, and venture capitalists dismissed the business as not scalable enough, lacking the growth trajectory that could lead to a billion-dollar valuation.

“It took 5 years to reach that scale of 5 gyms. If I had received Rs 4-5 crore at that point to strenghten our fundamentals, we could have grown the business significantly because all the foundational elements were already in place.”

“If the market had been more receptive to providing capital for businesses like mine, I would have definitely sought that funding.”

Instead, she made the difficult decision to sell her gyms to different owners and exit the business she had built from scratch.

The experience left her with a profound realization: India was full of fundamentally sound businesses that generated consistent profits but struggled to scale because they fell into a financing gap—too established for angel investors, too small for private equity, and not ‘disruptive’ enough for venture capital.

Archana decided to solve this problem herself. She decided to enter the venture business via angel investing and syndicates.

Her transition into investing began with backing a company called Smart Coin (now known as Onyv), which was a significant success.

She notes:

“It is on track for a 25x+ return. It's a very good outcome—it covers all my all my losses, and delivers significant additional returns.”

During 2017-18, the private markets were hit by a downturn and Archana began to get access to all sorts of interesting companies.

“I had a lot of misses like Classplus, Zetwerk, etc. But I did get Bank Open right (which would later become India's 100th unicorn).”

She went on to invest in over 150 companies. This phase, while expanding her portfolio and network, also exposed her to the limitations and challenges of angel investing.

“In that journey, I burned my hands in most of my investments although the winners were big enough to give a fantastic return anyway. What I found was that there's no due diligence, there's nothing even close to it,” she remarks candidly.

The lack of accountability post-investment particularly troubled her.

“After writing the check, many founders are not even willing to talk to you.”

That is when Archana crossed paths with Siddharth Sirigeri and Abhishek Mittal.

Birth of Endurance VC

Siddharth Sirigeri comes from a family business background, worked in structured finance at Citi, and brings a sharp eye for governance issues. His frustrations with the traditional VC model stemmed from repeated governance problems he witnessed as an angel investor.

He explains:

“I hated it when any startup I backed was failing because of mis-governance. You expect a high level of diligence. You assume that the lead investor will take care of it, but to be honest, they don't.”

Meanwhile, Abhishek Mittal brings manufacturing expertise, having set up two greenfield manufacturing plants producing 10,000MT p.a. of copper products. With experience managing functions across production, sales, partnerships, and P&Ls, Abhishek brings practical knowledge of scaling physical operations, especially useful for deep-tech companies.

His analytical approach to risk management is central to Endurance's philosophy. While he was investing as an angel and via syndicates, governance issues kept cropping up.

“When the invested as angels and syndicate, we were very small check on the captable, so we didn't have any say.”

“I like to think that beyond the point, no one knows anything,” Abhishek says. “It's more about risk management, managing uncertainty. That is what I think I want to keep learning and master.”

The team's collective experience as operators informs their hands-on investment approach.

Together, the three have been collaborating since 2020, with over 50 common angel investments and 15+ co-led syndicate deals—a partnership that combines venture expertise, financial acumen, and operational know-how.

Two-Pronged Investment Strategy

Endurance employs a hybrid strategy across two distinct approaches, but with a common thread—they typically enter a company’s cap table at what they describe as the ‘0.7 stage’.

“We don't come in at pre-seed. So let's say the ballpark in a consumer business is revenues around 1 crore a month,” explains Abhishek.

“We are bridging VC and micro PE to target outsized returns while mitigating risk by scaling cash-flow-positive and disruptive businesses.”

“Our hybrid approach manages risk while still offering exposure to potentially high-growth opportunities.”

1. Cash Flow Accelerator Strategy (Micro PE)

“We acquire stakes in profitable, asset-light businesses at low multiples, then scale them 10-100x using operational expertise and strategic debt, targeting 15-30x exits,” explains Siddharth.

“Small company valuation multiple is low as there are many such companies, but there are fewer large companies, which sometimes command higher valuation. We want to unlock valuation rerating with scale while deploying minimal equity.”

In this approach, Endurance seeks companies with:

Around Rs 10+ crore revenue with high gross margins

Valuations up to Rs 50 crore

Asset-light business models

Clear USP and low working capital cycle

Use debt to lever up the ROEs as the company matures, fetching rerated valuations

“Although there are many small profitable businesses in India, most don't scale due to lack of capital and ability to attract quality talent,” observes Archana.

“Coming from operating backgrounds, we understand this. The purpose of the fund is to bring our resources to exceptional operators who have built and survived under constraints and unlock scale together.”

2. Onshoring of IP (Deep Tech)

“Our second strategy is to back IP-driven tech startups in sectors like space, defense, health, consumer, manufacturing, agri and climate,” says Abhishek. “We're leveraging India's cost advantage and government tailwinds for targeting 30-100x returns on exits.”

This balance between cash flow-growth businesses and IP-driven technology creates portfolio diversification that helps manage risk while maintaining exposure to potentially outsized returns.

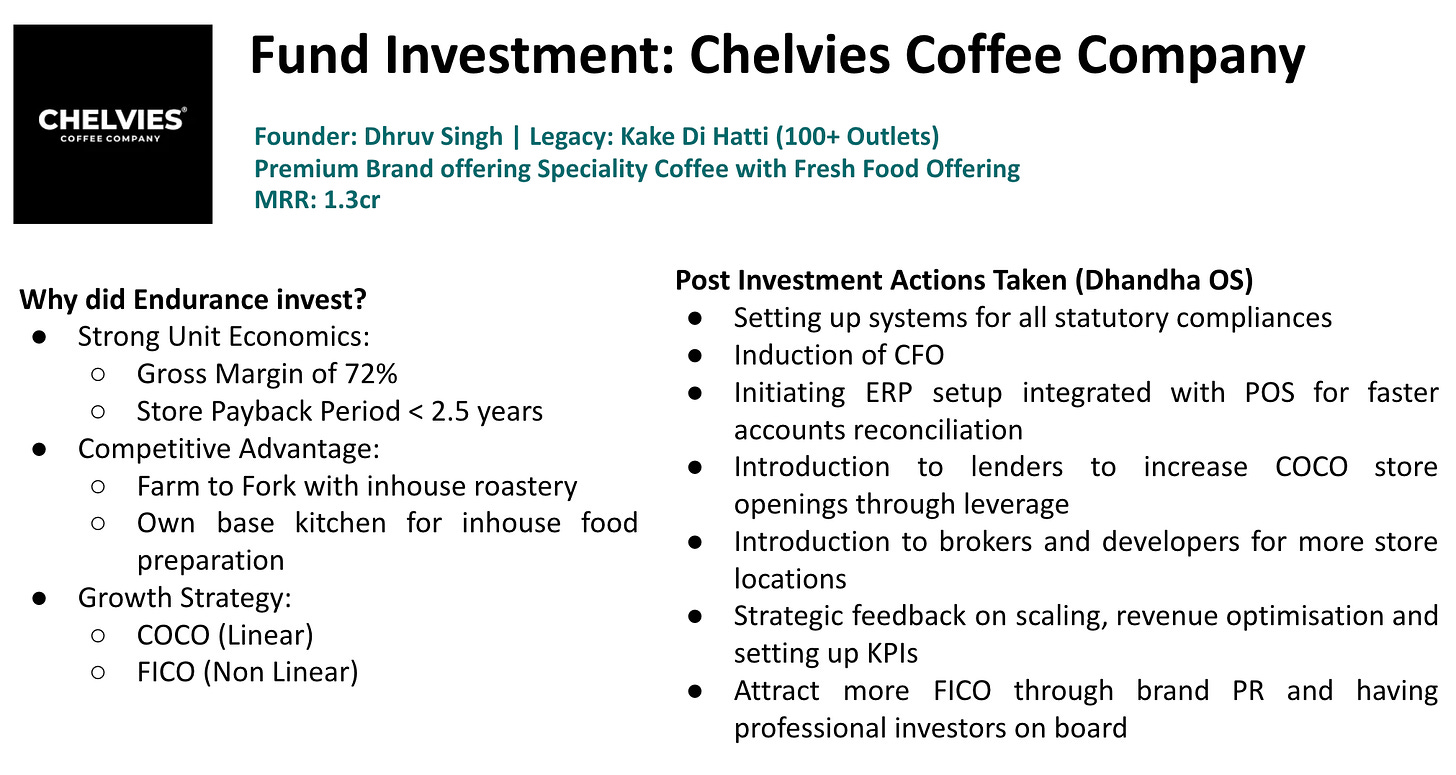

First Investment: Chelvies Coffee Company

For Archana, there's a certain poetic justice in using her success as an investor to solve the very problem that frustrated her as an entrepreneur.

The capital gap she encountered with her gym chain—too small for private equity, too ‘traditional’ for venture capital—is exactly the space Endurance now targets.

Once such bet, their first as part of Endurance is the Chelvies Coffee Company:

Chelvies founder Dhruv Singh is the 4th generation entrepreneur from his family.

The family business Kake di Hatti, which has 100+ locations, has been serving authentic North Indian cuisine for more than eight decades, since 1942!

The cafe chain’s numbers tell a compelling story: 72% gross margins, store payback periods under 2.5 years, and a vertically integrated model with Chelvies controlling everything from bean sourcing and roasting to food preparation.

Abhishek says:

“They are now at 6 cafes, at a run rate of approx Rs 14 crores a year.

The revenue per cafe is amongst the highest in the industry. Even for a 1200 sft space, it does approx. Rs 30 lakhs per month in the mature stores.”

Siddharth refers to the company being ‘default alive’:

“Theoretically, if you scale this to 100 cafes, it is Rs 250+ crores. For Endurance, there is a clear exit path at that scale. Worst case, at least there will be cash flow. You are not dying as long as you are running it efficiently.”

For Endurance's team, it checked all the boxes of what they call a ‘dhandha’ business—fundamentally sound, profitable, and ripe for scaling with the right guidance and capital.

Within weeks of their investment, Endurance brought in a seasoned CFO, implemented comprehensive financial reporting systems, integrated ERP with point-of-sale technology, connected Dhruv with lenders for expansion capital, and crafted a detailed growth strategy balancing company-owned stores with franchise opportunities.

Most VCs would have pushed for hyper-growth at all costs—burn cash, grab market share, and worry about profitability later.

Archana notes:

“We took the opposite approach. Let's strengthen the foundation first, then scale methodically through a combination of equity, strategic debt, and franchising.”

This hands-on, approach to scaling businesses represents Endurance Capital's deliberate departure from the prevailing venture capital playbook in India—a philosophy that has been years in the making.

Metrics Endurance Tracks

The firm expects to make only 8-10 consumer-focused ‘dhandha’ investments and 3-5 deep tech investments from their first fund, concentrating capital where they have a deep understanding.

When evaluating opportunities, they focus on:

Return on Capital Employed (ROCE) –

“At the early stage for the mature stores, it should be about 30% or so,” Abhishek explains. "But at a steady state, I would want it to be at 25%.”

Founder-market fit –

“Different industries need a very different persona. For example, in the case of Chelvies, you need somebody who's very alpha and very strong, who knows how to get work done out of people,” notes Abhishek.

Long-term orientation –

Siddharth emphasizes, “We are looking at working on improving the return on equity. ROE will decide what is the ultimate valuation you command at the time of exit.”

Concentrated Bets –

“With our kind of fund, we are just trying to make very concentrated bets,” Archana notes. “When they work, we will get a very, very large outcome. I can't afford to take very speculative bets like AI or blockchain, because who knows how it will be in three years.”

The Founder Factor: Psychology and Character Assessment

While Endurance Capital's thesis represents a departure from conventional VC thinking, Archana and her team remain steadfast in their belief that founder quality is the most critical factor in investment decisions.

“For me, the team was the most important consideration. Then scalability and business differentiators are second and third. Then the India angle—how relevant that business is for India,” she explains, ranking her investment criteria.

However, the team’s approach to evaluating founders reflects a sophisticated understanding of entrepreneurial psychology that goes beyond standard pattern-matching.

“A lot can be discerned from the very first meeting—whether the person is being authentic or not,” she notes. She has developed a keen eye for red flags that suggest founders lack genuine commitment or are driven primarily by FOMO (fear of missing out).

Such statements suggest contingency planning for failure rather than the unbounded commitment required for entrepreneurial success.

Endurance also scrutinizes the founders’ relationship with their chosen problem space.

“We prefer to invest in founders who have worked in that field,” the team explains. “Many founders will say they've done a whiteboard exercise, and that's how this idea emerged. They evaluated many ideas, and this one rose to the top.”

The team contrasts this theoretical approach with founders who have experienced the problem they're solving: “The other type of founder says, ‘While I was working for a company, I identified this problem, this is where processes get stuck, and that challenge applies to many companies.’” This experiential understanding of the problem space indicates deeper commitment and insight.

Name-dropping is another warning sign in Endurance’s assessment framework.

“When people come in and start saying ‘I know this person, I know that person’—if they know everyone important, then why are they approaching us? They should have already secured funding from somewhere else instead of coming to us.”

For serial entrepreneurs, Endurance digs deeper into their past ventures.

“If a founder has already built a company and it did not work out, then we need to understand why that company closed. How persistently did they try to revive it?”

The determination demonstrated in previous ventures serves as a key indicator of resilience.

This focus on resilience stems from Endurance's observation of a troubling pattern among some founders:

“They can raise money during boom times when VCs are eager to deploy capital. They receive funding without a clear plan. They observe what their peers are doing and simply spend through their runway. Once the money is gone, they simply announce they're closing the company. Those aren’t the founders we want to work with.”

While acknowledging that success involves factors beyond mere effort—‘Success isn't solely determined by effort. Success also involves a substantial element of luck’—Endurance insists on evaluating whether a founder ‘has consistently put forth their best effort, time and again.’

This nuanced approach to founder assessment complements Endurance Capital's broader thesis. By focusing on businesses that are already demonstrating profitability and PMF, the firm reduces the risk that comes with unproven founders or models. Yet by maintaining rigorous standards for founder quality, it increases the probability that these businesses will successfully scale with the additional capital.

Building Businesses That Endure

As Endurance builds its portfolio, its approach is finding resonance among founders who aren't aligned with the traditional venture-backed hypergrowth model.

Archana describes how this contrasts with the typical venture mindset:

“Our play with Micro-PE as a strategy is to focus on businesses that cannot become a billion dollar outcome but can definitely become a $100 million to $300 million outcome at which scale they become fund-returners.”

“While having the deep-tech piece ensures we are keeping the door open for a very large alpha.”

Siddharth elaborates on their strategy:

“We want larger stakes in the company. Get board seats. And be a kind of soundboard for the founder. The first big learning was that mis-governance was a big headache for us when we invested as angels in syndicate. We want to avoid that.”

Abhishek emphasizes:

“We named our fund Endurance—the number one thing is to keep playing the game. If you survive long enough, you will increase your chances of success. Don't quit. Because if you are there in the market, maybe sometime that luck will come, or certain trends will work in your favor, or you will be able to crack something.”

For India's evolving entrepreneurial ecosystem, this patient capital approach could prove to be exactly what many sustainable, profitable businesses need to flourish over the long term.

Note: Endurance VC is an investment firm founded by Archana Priyadarshini, Siddharth Sirigeri, and Abhishek Mittal. The firm’s flagship fund focuses on businesses with sustainable unit economics.

If you think your company fits the bill or you are an investor (family office/corporates/individuals) looking to invest in Endurance VC’s strategy and want more information, kindly write to us at banjan@tal64.com.